De minimis suspended globally

Effective August 29, imported goods valued at $800 or less, not sent via the international postal network, will incur applicable duties. For items shipped through the postal system, duties will be assessed as follows:

Ad valorem duty: Based on the effective tariff rate under the International Emergency Economic Powers Act (IEEPA) for the product's origin, applied to each package's value.

Specific duty: Ranges from $80 to $200 per item, depending on the IEEPA tariff rate for the origin. This method is available for six months before switching to ad valorem.

Exemptions under 19 U.S.C. 1321(a)(2)(A) and (B) still apply, allowing American travelers to bring back $200 in personal items and receive gifts valued at $100 or less duty-free.

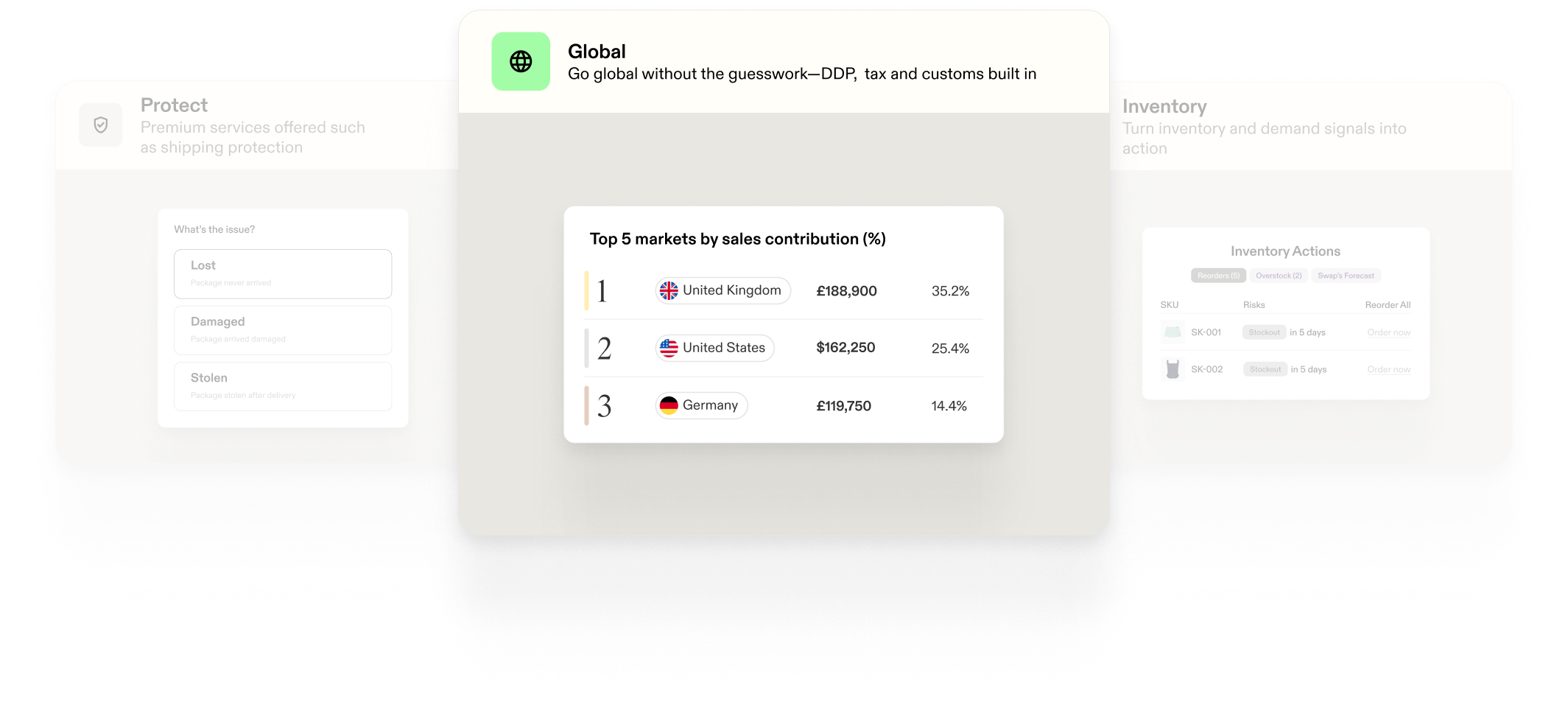

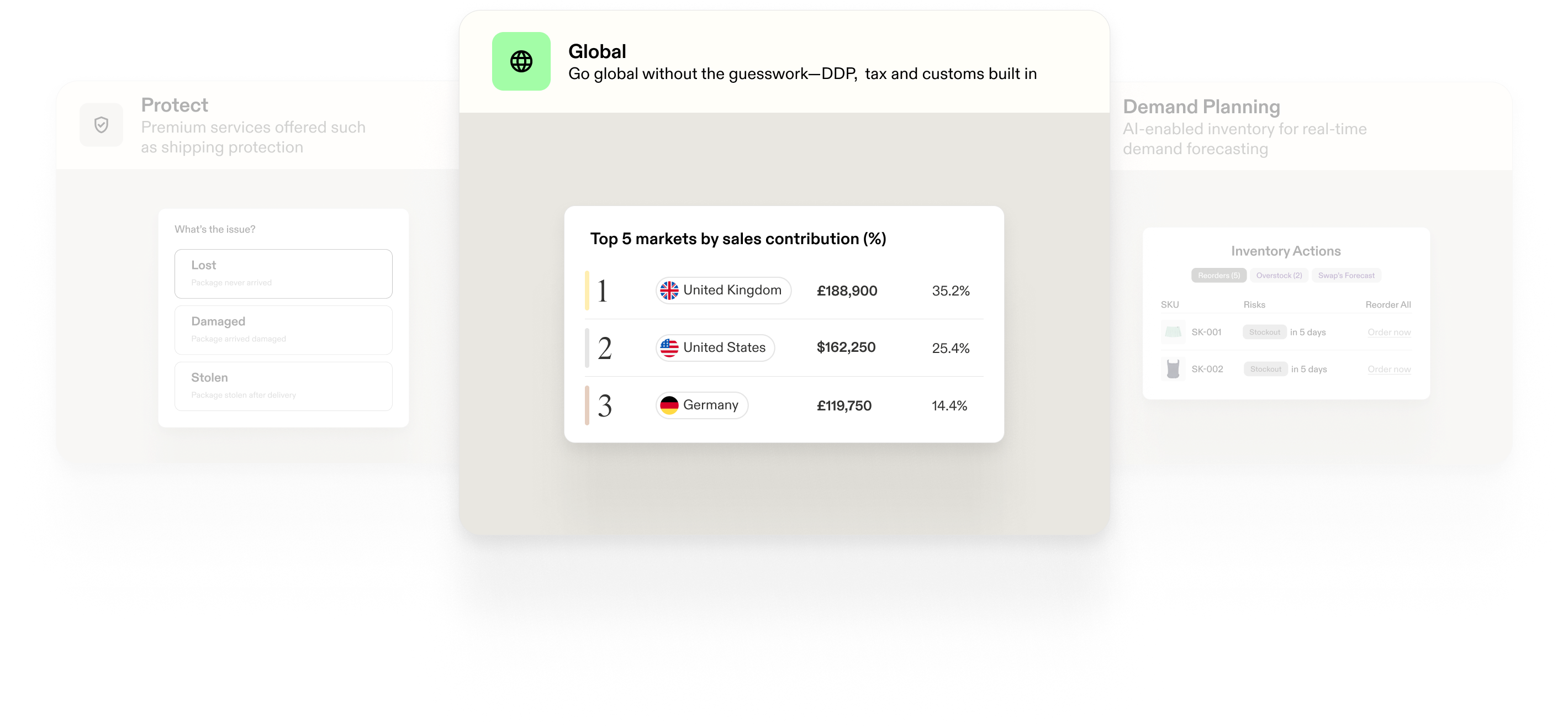

Your ultimate tariff compliance partner

Clear goods at fair market value via a UK -> US intra-company transfer. Through Clear by Swap Global, duties are assessed on the fair market value of goods - not on the final retail price (RRP).

To Get Started...

- Use Swap Global

- Use Swap shipping account

- Integrated Swap commercial invoice printer

Mitigate your brand’s exposure to tariffs.

See the Swap difference in action.

Book a free, 15-minute demo with a real human person

See your operations streamlined by the power of Swap.