Stay compliant across all borders — without slowing down.

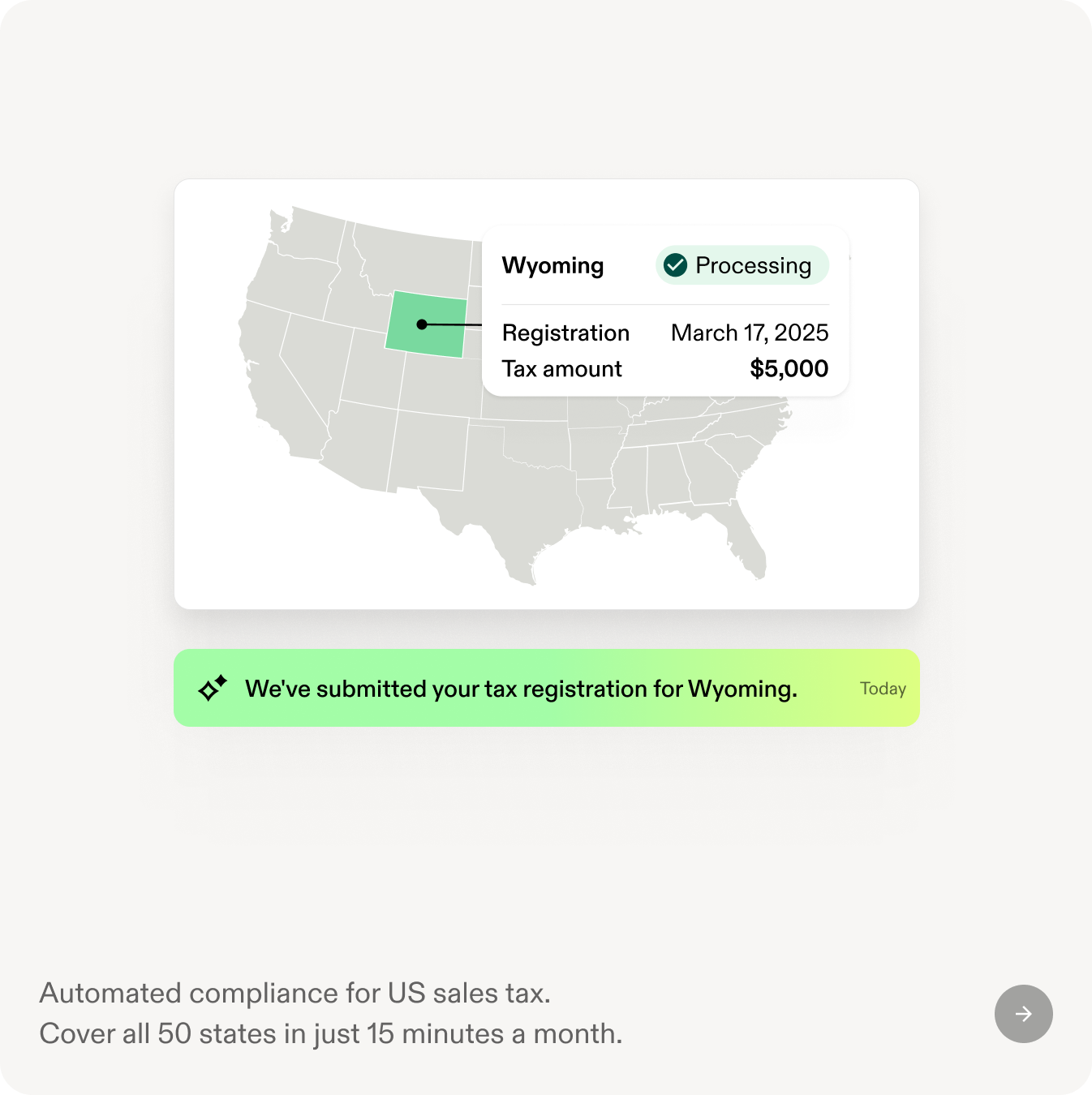

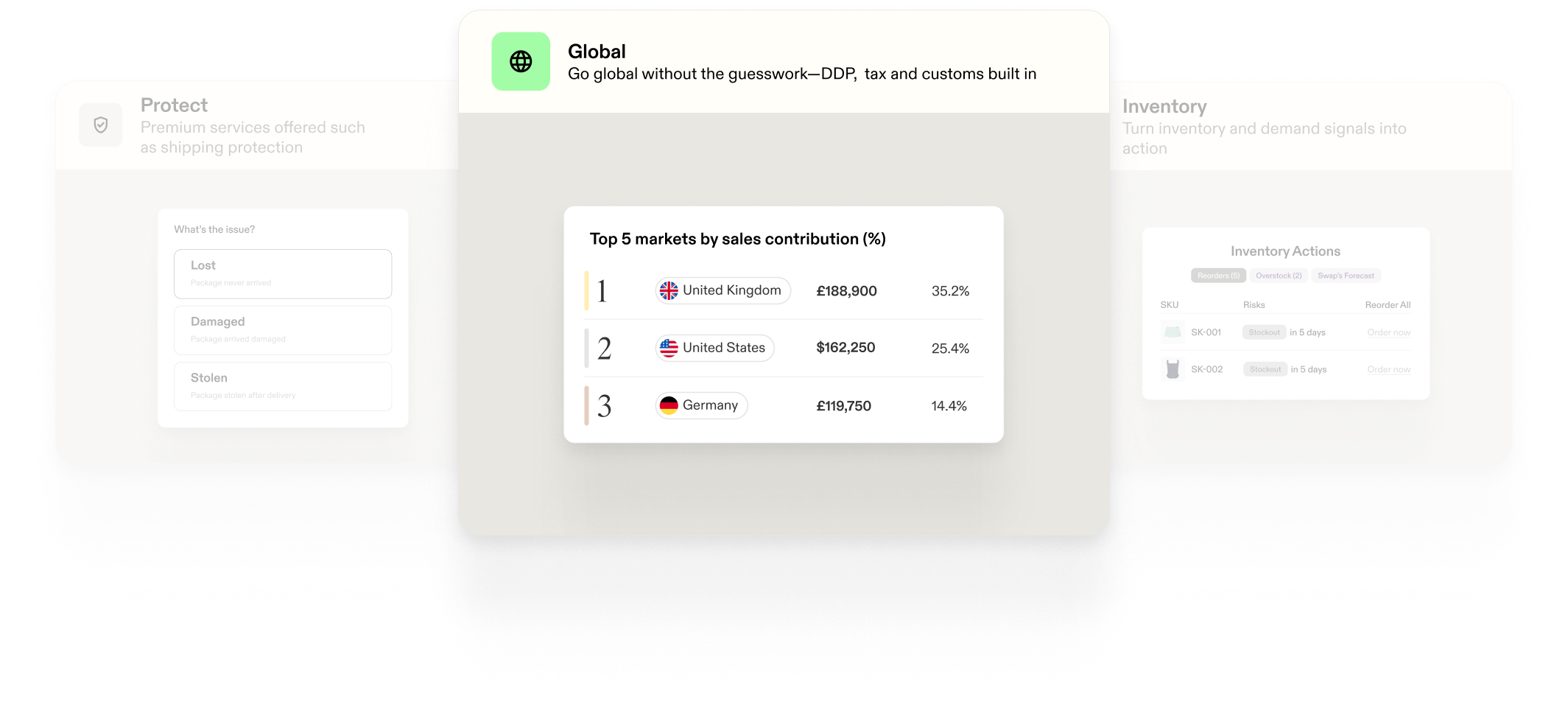

Swap automates tax compliance across the U.S. and international markets — replacing fragmented tools with one system built for scale. Expand faster, reduce risk, and stay audit-ready by default.

One system that doesn’t break as you scale.

Compliance shouldn’t consume your team.

Being prepared shouldn’t be reactive.

Errors compound fast at scale.

Growth without headcount creep.

Predictable costs, connected workflows.

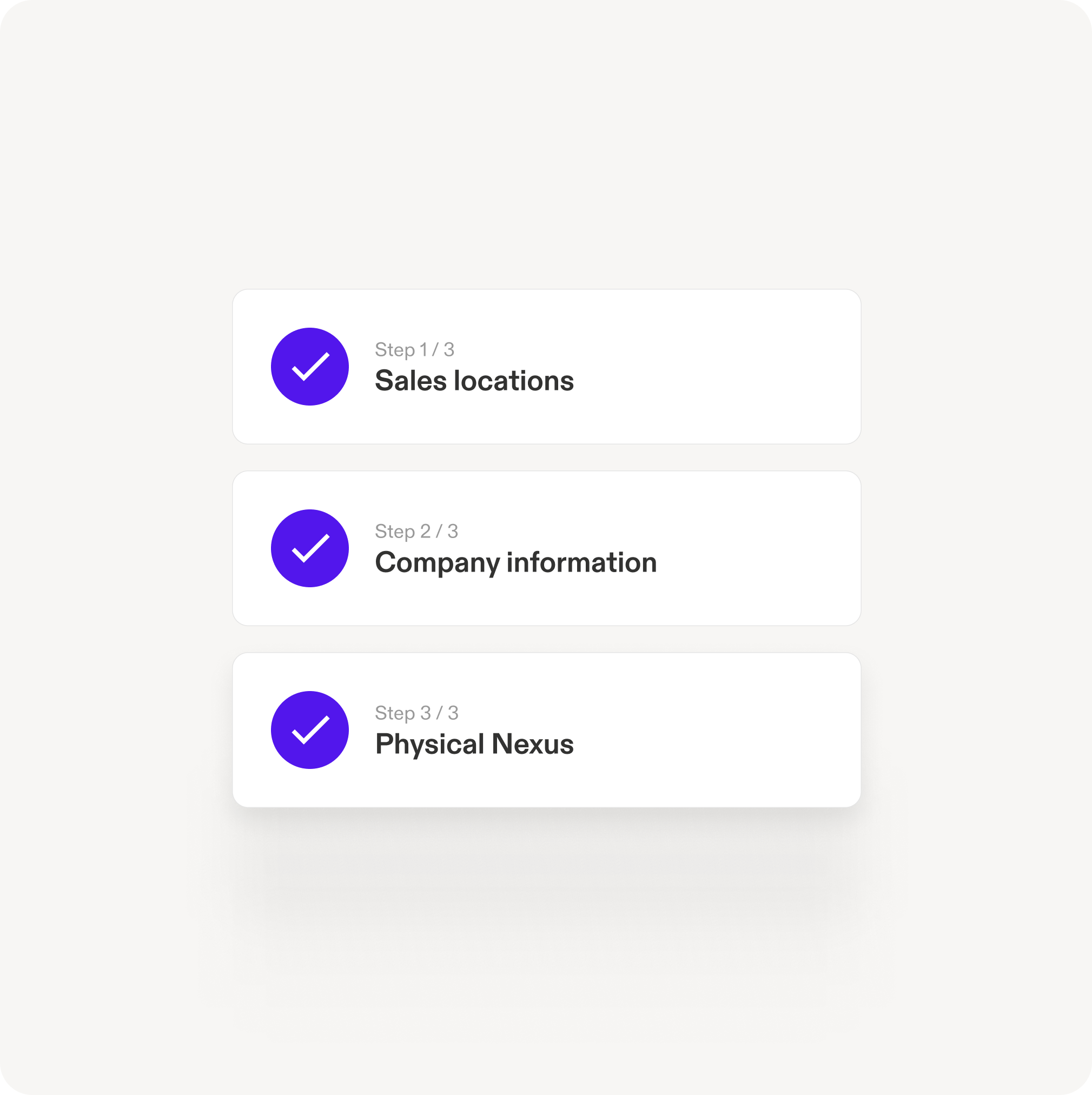

Better management, less manual

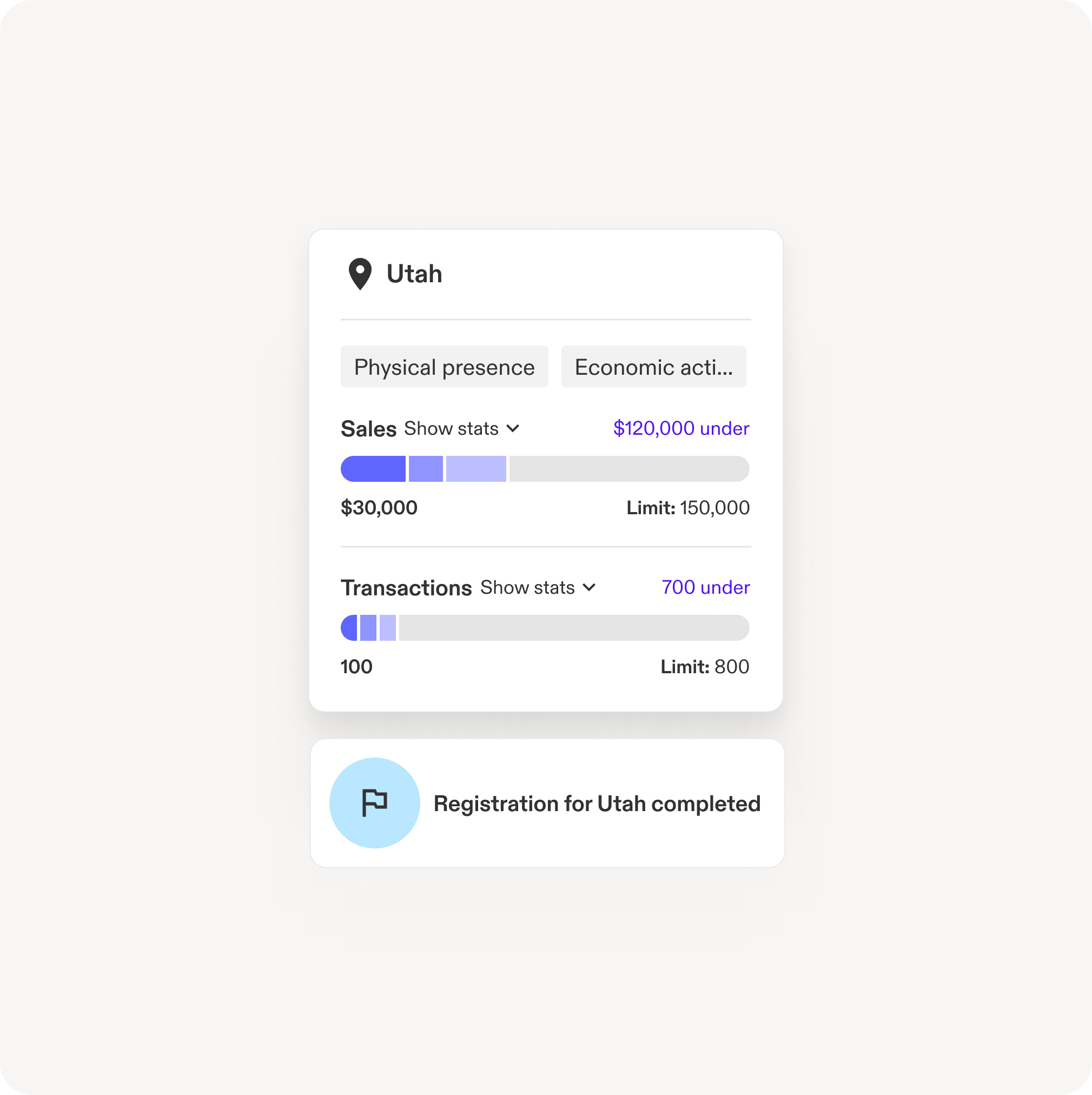

We automate the painful parts of compliance: tracking where you owe, registering in new regions, filing on time, and handling notices before they hit your inbox.

No portals, no spreadsheets, and no added complexity.

- Nexus monitoring and analysis

- Automated tax registration & filing across the U.S. and supported international markets

- State and tax authority mail handled for you

Stay protected (even when compliance gets complex)

Store and manage certificates, resolve historical exposure, and stay prepared as regulations change. Swap keeps everything organized, documented, and audit-ready by default.

- VDA & exemption cert management

- HS code classification to support accurate global tax treatment

- Custom return rules by product, region, or scenario

- Audit-ready reporting across markets

Built for lean teams scaling across markets

Compliance shouldn’t block expansion. Swap helps teams move fast with automation that supports international operations — without adding operational drag.

- Supports tax compliance anywhere you operate

- Built to scale with global expansion

- Operational efficiency without added headcount

- Transparent pricing

Compliance works best when it’s connected. Swap integrates tax compliance with global operations, demand planning, returns, and more — all in one system.

Stay more than compliant. Stay connected.

Book a free, 15-minute demo with a real human person

See your operations streamlined by the power of Swap.